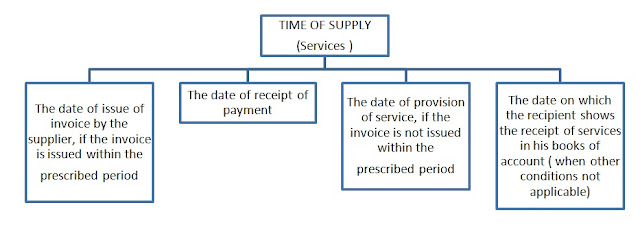

The Time of Supply is also well defined for the

services sector too. The liability to pay tax on services shall arise at the

time of supply, as determined according to relevant conditions. In each of the

cases, the Time of Supply shall be the earliest date applicable as per

conditions.

When the supplier of taxable service receives an

amount up to one thousand rupees in excess of the amount indicated in the tax

invoice, the time of supply to the extent of such excess amount shall (at the

option of the said supplier) be the date of issue of invoice relating to such

excess amount.

The supply shall be deemed to have been

made to the extent it is covered by the invoice or the payment. The date of

receipt of payment shall be the date on which the payment is entered in the

books of account of the supplier or the

date on which the payment is credited to his bank account, whichever is

earlier.

Similarly, for supplies on which the tax becomes payable on

Reverse charge basis, the following rules become applicable. The Time of Supply shall be the earliest date applicable as per

conditions.

When it is not possible to determine the

time of supply by the above mentioned criteria,

the time of supply shall be the date of entry in the books of account of

the recipient of supply.

In case of supply by associated

enterprises, where the supplier of service is located outside India, the time

of supply shall be the date of entry in

the books of account of the recipient of supply or the date of payment,

whichever is earlier.

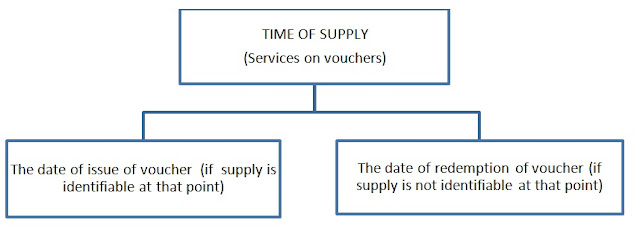

For supply of vouchers by a supplier for services, the

following rules become applicable. The Time of Supply

shall be the earliest date applicable as per conditions.

When

it is not possible to determine the time of supply under any of the

conditions or cases listed above, the time of supply shall be one of the

following:

·

The date on which periodical return

is to be filed

·

The date on which the tax is

paid.

The time of supply to the extent it

relates to an addition in the value of supply by way of interest, late fee or

penalty for delayed payment of any consideration shall be the date on which the

supplier receives such addition in value.

No comments:

Post a Comment